Navigating Trade Tensions, Workforce Realities & Growth Opportunities

Canada’s Economic Outlook for Manufacturers

On October 6, 2025, EMC and BDC hosted our second annual Economic Outlook for Manufacturers national briefing – welcoming more than 300 attendees, and many more accessing the recording afterward. It was my pleasure to moderate the session, which featured two of Canada’s foremost though-leaders on economic and manufacturing trends: Pierre Cléroux, Vice President of Research and Chief Economist at BDC, and Jean-Pierre (JP) Giroux, President of EMC.

As manufacturers across Canada navigate a business landscape defined by rising costs, trade disruptions, and shifting workforce dynamics, this event provided much-needed clarity – and importantly, a dose of cautious optimism.

Modest Growth, Not Recession: Economic Forecast with BDC’s Pierre Cléroux

Pierre Cléroux’s address delivered a clear message: Canada is not headed into a recession. Despite ongoing trade tensions and external shocks, the economy is stabilizing, albeit below full potential with modest growth in 2025 and around 1% growth in 2026.

“We’re not in recession. We’re not going into a recession.

But we are still working below our capacity,”Pierre Cléroux, Chief Economist, BDC

Key Economic Takeaways:

Pierre provided a very thorough overview of Canada’s economic performance, and the ‘new reality’ impacts, challenges and opportunities facing our manufacturing sector:

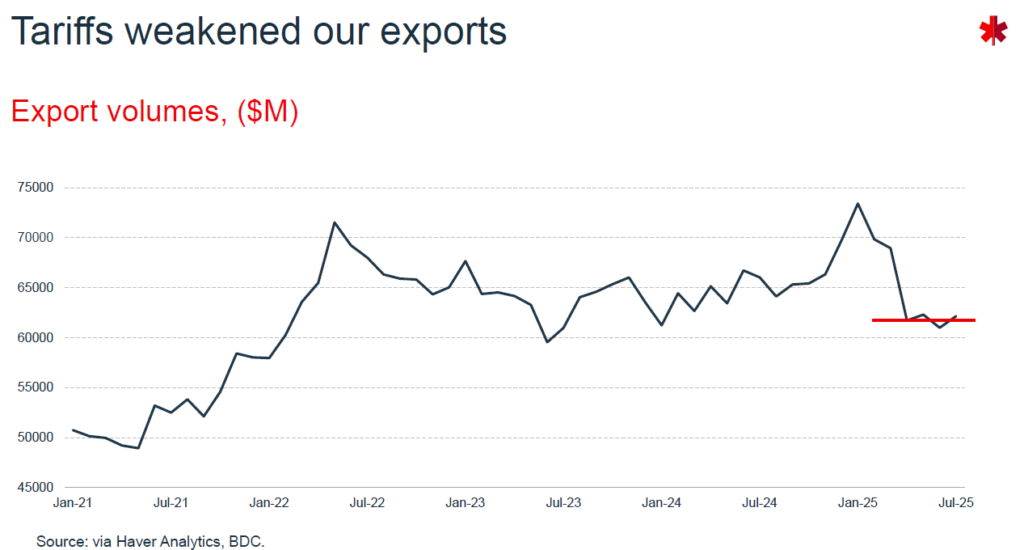

- Tariffs are taking a toll, especially on exports and sectors like primary metals and transportation equipment. Ontario has borne the brunt, losing 50,000 jobs since January 2025.

- Exports are down 27% since tariffs were imposed, but appear to have stabilized to a new lower baseline.

- Consumer spending remains resilient, supporting 60% of GDP.

- Housing starts are rebounding, aided by interest rate cuts and federal investments like the Build Canada Homes

- Inflation is under control (~2%), enabling the Bank of Canada to lower interest rates to 2.5%, with another cut expected before year-end.

- Real GDP growth forecast: ~0.5% for 2025 and 0%–1.2% in 2026, remaining below Canada’s potential but positive.

BDC data shows Canada’s export volumes have fallen 27% since tariffs were introduced, with Ontario bearing the deepest employment losses. (Source: BDC Economic Outlook, Oct 2025)

Pierre also emphasized how three major federal investments in housing, defense, and electricity infrastructure will open up new domestic manufacturing opportunities across Canada:

- $13B+ in housing construction (Build Canada Homes initiative)

- $21B+ in defense procurement, benefitting shipbuilding, vehicle manufacturing, aerospace, and electronics

- Over $150B in electrical grid infrastructure modernization upgrades by 2035 (e.g. $100B in Québec, $36B in BC, $16B in Ontario)

“The manufacturing sector is readjusting.

We believe the worst is behind us – growth will be modest, but positive.”Pierre Cléroux

While the export outlook remains constrained by U.S. tariffs, BDC’s advice was clear: diversify markets, boost productivity, and invest in tech adoption to maintain competitiveness.

Issues Affecting Manufacturing: EMC’s Sector Pulse with JP Giroux

EMC President Jean-Pierre (JP) Giroux followed with an insightful overview of EMC’s Workforce Pulse – developed in partnership with the Future Skills Centre and 13 national organizations.

The Workforce Pulse captured real-time insights from over 2,145 employers, including more than 800 manufacturers (predominantly SMEs), highlighting both the resilience of Canada’s manufacturing community and the pressures it continues to face.

Top Issues Affecting Manufacturers:

- Trade exposure and supply chain disruptions

- Skills and labour shortages – especially in skilled trades and technical occupations

- Rising energy and operational costs

- Need for new customer acquisition and market diversification

“The shift from general labour to skilled technical roles is now undeniable,”

Jean-Pierre (JP) Giroux, President, EMC

Referencing Pulse data, JP noted that skilled trades are now ranked ahead of general labour as the most difficult positions to fill in manufacturing today.

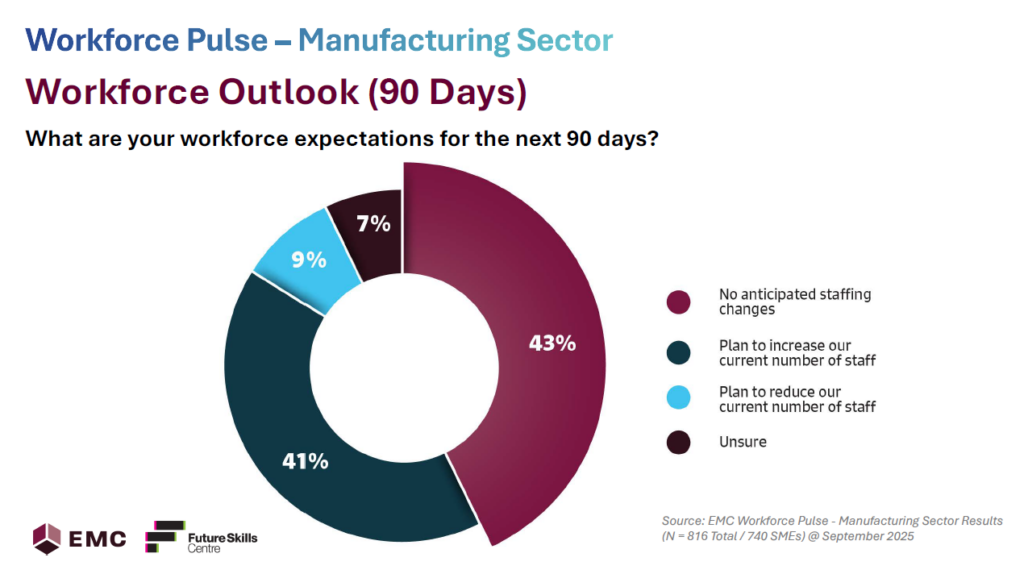

41% of manufacturers are still actively recruiting; 9% plan reductions and 7% are uncertain, reflecting continued volatility. (Source: EMC Workforce Pulse, Sept 2025)

Workforce Pulse Highlights:

- 43% of manufacturers indicate stable workforce levels.

- 41% of manufacturers continue to recruit – unchanged from prior surveys.

- 9% plan to reduce staff over the next 90 days; 7% remain unsure, indicating the weight of uncertainty.

- Key workforce needs: Hiring/retention, productivity, supply chain streamlining, and upskilling.

- Most disruptive trend: Labour shortages and retention – particularly in supervisory, technical, and sales/BD roles.

JP also shared how EMC is addressing these issues through:

- Green and advanced manufacturing training programs

- Workforce upskilling across technical, leadership, and essential skills

- National working groups focused on productivity, supply chain mapping, and technology culture

We’re seeing a real shift – SMEs embracing robotics and automation, with the most skilled people now working beside the robots,” reinforcing that adoption of

AI and advanced manufacturing is accelerating, but demands targeted support.JP Giroux

Q&A Highlights and Final Reflections

The session’s live Q&A covered several timely themes:

- Energy cost competitiveness: While manufacturers are looking for lower electricity rates, Pierre emphasized that provinces are currently investing heavily in grid upgrades, making near-term rate reductions unlikely.

- Immigration and labour supply: Canada’s reduced immigration targets will affect consumption and hiring. Businesses were encouraged to invest in automation and workforce development to mitigate risk.

- AI and cybersecurity: As AI adoption increases, so does the need for cybersecurity, IP protection, and standardized risk management

- CUSMA renegotiation (2026): Pierre positioned this as a potential opportunity to eliminate tariffs and strengthen the trade framework – but acknowledged the uncertainty ahead.

Looking Ahead

This national briefing underscored a key central message: while growth will be modest and uncertainty persistent, Canada’s manufacturing sector is not standing still.

Between BDC’s data-backed outlook and EMC’s workforce intelligence three clear actions emerged for 2026

- Pivot toward new markets – Asia-Pacific, Europe, and stronger domestic supply-chain connections

- Invest in technology and productivity to protect margins and profitability

- Strengthen Workforce Readiness through targeted training and retention strategies

“Uncertainty doesn’t mean recession

– it means we must make decisions differently.”Pierre Cléroux

Next Steps & Resources

For those who were unable to join us, you can access Pierre’s and JP’s presentations below, along with the session recording and EMC’s Manufacturing Workforce Pulse Report

Also watch for the upcoming release of EMC’s 2026 Advanced Manufacturing Report (with Plant Magazine and Canadian Manufacturing Online), and stay connected through our Manufacturing Excellence Forums and regional working groups this Fall and throughout the year.

As I noted in the recent Fall edition of Plant Magazine, “Despite the challenges, Canadian manufacturers remain builders, problem solvers and innovators at heart. Manufacturers are not retreating from the future – they are reshaping it.”

Together, we’re helping to elevate Canadian manufacturers – building resilience, growing capabilities, and creating value from innovation, collaboration, and new opportunities.

Written by Scott McNeil-Smith is Vice President, Manufacturing Sector Performance for Excellence in Manufacturing Consortium of Canada (EMC, Canada’s largest manufacturing consortium.